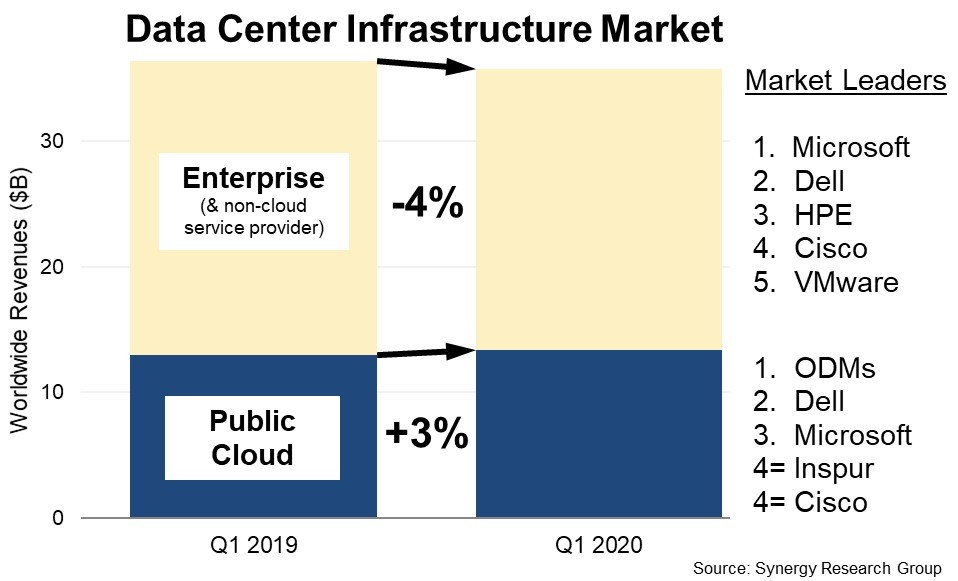

The pandemic had relatively little impact on public cloud data center infrastructure, where hardware and software vendors saw their revenues increase by 3%, but sales to enterprises and traditional service providers declined by 4%. In terms of market share, ODMs in aggregate account for the largest portion of the public cloud market, with Dell ISG being the leading individual vendor, followed by Microsoft, Inspur and Cisco. The Q1 market leader in enterprise infrastructure was Microsoft, followed by Dell, HPE, Cisco and VMware.

Total data center infrastructure equipment revenues, including both cloud and non-cloud, hardware and software, were $35.8 billion in Q1, with public cloud infrastructure accounting for over 37% of the total. The main hardware-oriented segments of servers, storage and networking in aggregate accounted for 73% of the data center infrastructure market. OS, virtualization software, cloud management and network security account for the balance. By segment, Dell is the leader in both server and storage revenues, while Cisco is dominant in the networking segment. Microsoft features heavily in the rankings due to its position in server OS and virtualization applications. Outside of these three, the other leading vendors in the market are HPE, VMware, Inspur, Huawei, IBM, Lenovo and NetApp. Inspur is the major vendor with the highest growth rate.

"Cloud service revenues continue to grow by almost 40% per year, enterprise SaaS revenues are growing by almost 25%, search/social networking revenues are growing by over 15%, and e-commerce revenues are growing by over 20%, all of which are helping to drive growth and increased spending on public cloud infrastructure," said John Dinsdale, a Chief Analyst at Synergy Research Group. "Notably, most of these services are either little impacted by COVID-19 or may be stimulated by changed enterprise and consumer behavior. On the other hand, many enterprises have been negatively impacted by the pandemic resulting in increased pressure on capital budgets and more impetus on shifting workloads to public cloud providers."