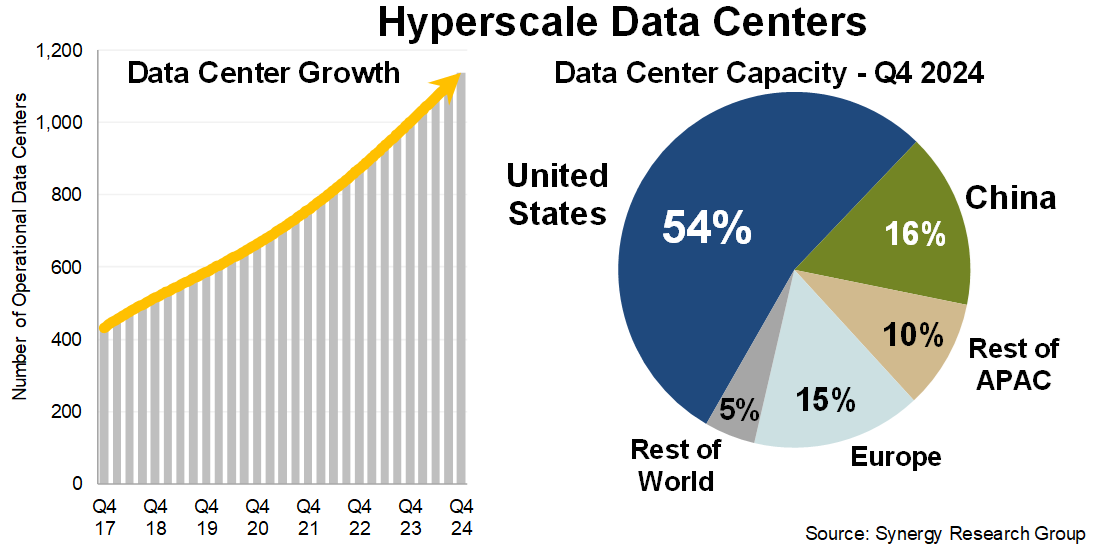

Meanwhile it has taken less than four years for the total capacity of operational hyperscale data centers to double, as the average capacity of newly opened facilities continues to climb. Synergy's data shows that the United States still accounts for well over half of total worldwide capacity, measured by MW of critical IT load, with Europe and China each accounting for about a third of the balance. Looking ahead, Synergy forecasts that it will take less than four years for total hyperscale data center capacity to double once again. Each year will see a reasonably steady 130-140 additional hyperscale data centers coming online, but overall capacity growth will be driven more by the ever-larger scale of those newly opened data centers. Generative AI technology is a prime reason for that increased scale.

The research is based on an analysis of the data center footprint of 19 of the world's major cloud and internet service firms, including the largest operators in SaaS, IaaS, PaaS, search, social networking, e-commerce and gaming. The companies with the broadest data center footprint are the leading cloud providers – Amazon, Microsoft and Google. In addition to a huge data center footprint in their home US market, each also has multiple data centers in many other countries around the world. In aggregate the three now account for 59% of all hyperscale data center capacity. They are followed in the ranking by Meta, Alibaba, Tencent, Apple, ByteDance and then other relatively smaller hyperscale operators. Synergy's forecast growth numbers are based in large part on its tracking of hyperscale operators' pipeline of future data centers. Synergy's known pipeline of future hyperscale data centers currently stands at 504 facilities which are at various stages of being planned, constructed or fitted out.

"137 new hyperscale data centers came online in 2024, continuing a steady trend in growth that goes back many years. The big difference now is the increased scale of many of those new data centers. Historically the average size of new data centers was increasing gradually, but this trend has become supercharged in the last few quarters as companies build out AI-oriented infrastructure," said John Dinsdale, a Chief Analyst at Synergy Research Group. "We have filtered out smaller points of presence that some like to claim are cloud data centers, and we have also discounted inflated marketing-oriented claims which are more about potential futures rather than currently deployed infrastructure. The resulting actual numbers show new data centers that are a mix of owned versus leased, home country versus international, and large versus super-large, but in aggregate the trend towards increased size is very clear. It is also very clear that the US will continue to dwarf all other countries and regions as the main home for hyperscale infrastructure."