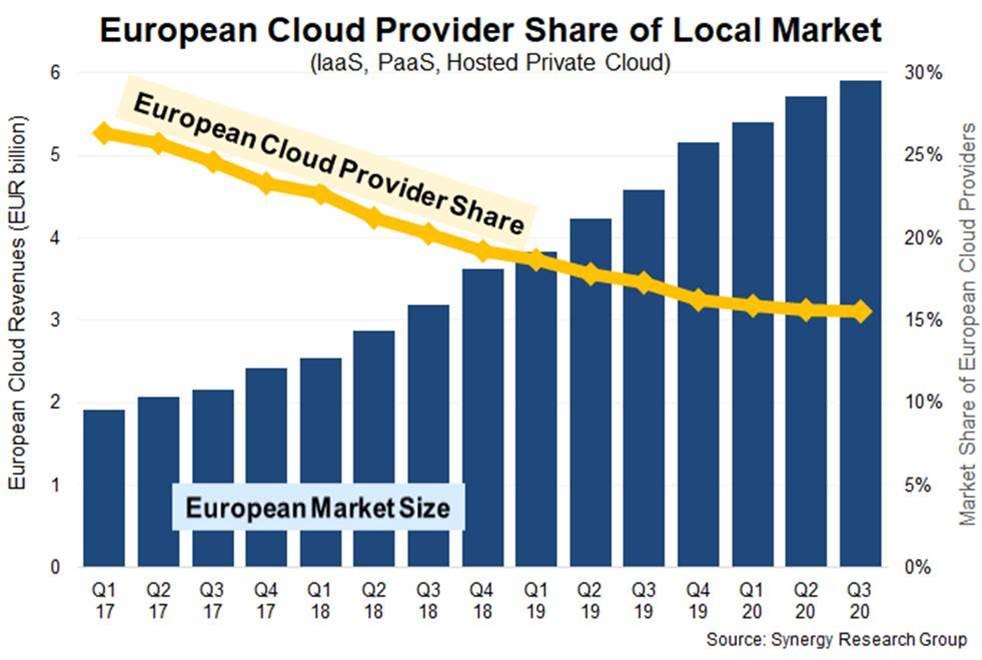

Over that same period European service providers have grown their cloud revenues but their market share has declined from 26% to under 16%, driven down by the rise of Amazon, Microsoft and Google. These three leading global cloud providers have grown aggressively and now account for 66% of the regional market. The balance of the European market is accounted for by smaller US and Asian cloud providers, who are also steadily losing market share. Among the European cloud providers, Deutsche Telekom is the leader accounting for 2% of the European market, followed by OVHcloud, Orange and a long list of national telcos and regional cloud and hosting specialists.

Including forecast fourth quarter business, Synergy estimates that full-year 2020 European cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) will be over EUR 23 billion, up 31% from 2019. IaaS and PaaS services account for almost 80% of the market and they are also growing more rapidly than the smaller hosted or managed private cloud segment. Some of the highest growth is seen in PaaS with database, IoT and analytics services.

“European cloud providers are trying to gain more traction in the market by focusing on customer segments and use cases that have stricter data sovereignty and privacy requirements. This has led to the Gaia-X initiative which represents an attempt to reverse the fortunes of the European cloud industry,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Their efforts are laudable but the trouble is that this is a bit like King Canute attempting to stop an incoming tide. The big three US cloud providers now have 67 hyperscale data centers in Europe and over 150 additional local points of presence, while the tier two US providers have another 36 major data centers. In total their European capex over the last four quarters has totaled EUR 12 billion, up 20% from the previous four quarters. European firms are facing a huge challenge if they want to break out of their niche-like positions – the revenue growth opportunities are massive but so too is the funding and willpower required to tap into those opportunities.”