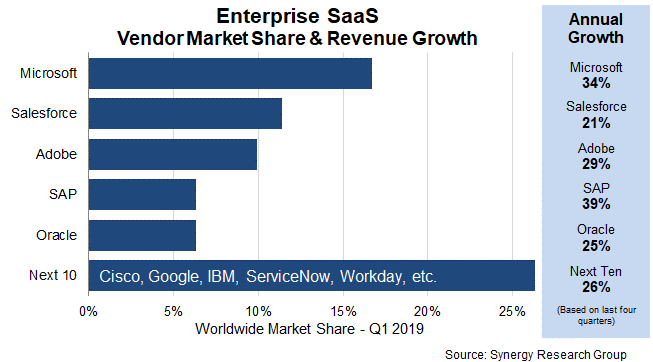

The market continues to grow at almost 30% per year. Microsoft has a worldwide market share of 17% and continues to enhance its overall market leadership, thanks primarily to its dominance in the high-growth collaboration segment. While Microsoft’s growth rate is diminishing due the massive scale it has achieved, over the last four quarters it has averaged 34%, comfortably higher than the overall market growth rate. Salesforce is the second ranked vendor in the overall enterprise SaaS market thanks to being the dominant player in CRM, though this segment has relatively low growth compared to other SaaS segments. The two leaders are followed by Adobe, SAP and Oracle, with SAP achieving the highest growth rate among these three. In aggregate these top five SaaS vendors now account for just over half of the total market. The next ten vendors account for another 26% of the market. Among these ten, the vendors with the highest growth rates are Google, ServiceNow and Workday. It’s notable that the market remains quite fragmented, with different vendors leading each of the main market segments.

While in many ways the enterprise SaaS market is now mature, it still accounts for barely more than 20% of total enterprise software spending and therefore remains small compared to on-premise software, meaning that SaaS growth will remain buoyant for many years to come. While SaaS growth rate isn’t as high as IaaS and PaaS, the SaaS market is substantially bigger and it will remain so until 2023. Synergy forecasts strong growth across all SaaS segments and all geographic regions.

“The SaaS vendor landscape essentially breaks out into three camps – traditional enterprise software vendors, relatively new born-in-the-cloud players and large IT vendors that are looking to expand more into software markets,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “In the first camp you have companies like Microsoft, SAP, Oracle and IBM that have a huge base of on-premise software customers that they can convert to a SaaS-based consumption model. Born-in-the-cloud vendors include Workday, Zendesk, ServiceNow, Atlassian and Splunk, who tend to have much higher growth rates. Meanwhile Google and Cisco are making an impact in the SaaS market, via Google’s G Suite and Cisco’s collaboration apps and multiple software vendor acquisitions. There will be consolidation, with the impending Salesforce acquisition of Tableau Software being a prime example, but there will remain many opportunities for new market entrants to make an impact.”